A popular investing option for retirement savings is the Provident Fund (PF), which is required for employees making a monthly PF contribution of at least Rs 15,000.

Employees are excluded from income tax on PF payments up to Rs 1.5 lakh in a single fiscal year, as per Section 80C of the Income Tax Act. Members of the Employees’ Provident Fund Organization (EPFO) also enjoy several other benefits. Let’s examine the nine advantages of PF accounts. Below are the advantages of PF provided:

The Advantages Of PF That All Salaried Persons Must Know

Scheme For Employee Deposit-Linked Insurance (EDLI)

In the terrible event that you pass away while still employed, subscribers to the Employee Provident Fund (EPF) now have the benefit of free insurance coverage up to Rs 7 lakh. The Employees’ Deposit Linked Insurance (EDLI) program enables this coverage. May saw a recent improvement and increase in flexibility for the insurance benefits offered by the EDLI system. The maximum insurance payment amount has been increased from Rs 6 lakh to Rs 7 lakh, providing beneficiaries with more financial security.

Pension Plan For Holders Of EPF Accounts

Owners of EPF accounts are qualified for the Pension Scheme 1995 (EPS), a lifetime pension plan. As of September 1, 2014, retirees must get a minimum monthly pension of Rs. 1,000/-under the terms of the Employees’ Pension Scheme (EPS) of 1995. This guarantees that the Employees’ Pension Scheme (EPS), established in 1995, provides pensioners with an acceptable level of financial assistance.

Withdrawals Of Partial Funds

Partial withdrawals are allowed by the Employees’ Provident Fund Organization (EPFO) in certain situations. These include situations such as a medical emergency, loan payback, building or buying a new home, rebuilding an existing home, and paying for one’s own or one’s children’s wedding.

Contributions From Employers And Employees

Both the employer and the employee contribute money to the provident fund (PF) during its construction. Usually, the company matches the employee’s contribution and contributes 12% of the employee’s base pay and dearness allowance. The joint effort helps the PF fund to expand quickly.

Loan Against Provident Funds

An employee-provided benefit plan (EPF) member may be able to get a loan with an interest rate as low as 1% in an emergency. After disbursing, the borrower must repay this short-term loan in full within 36 months. On March 12, the interest rate on Employee Provident Fund (EPF) deposits fell to 8.1% for the 2021–22 fiscal year, from 8.5% the previous year—the lowest level in forty years. Since 1977–1978—when it was 8%—this is the lowest interest rate that employees have paid into their retirement fund. According to a statement from the Ministry of Labour, the Central Board of Trustees (CBT), led by Union Labour and Employment Minister Bhupendra Yadav, proposed the 8.1% interest rate during its meeting in Guwahati.

Transferability And Portability

In India, provident fund (PF) accounts are portable; therefore, employees can transfer their PF balances when they change jobs. People can maintain their PF funds by using this approach, which prevents them from opening new accounts. The Universal Account Number (UAN) makes it easy to track the PF balance and simplifies the transfer process. This technique makes it simple for employees to roll over their PF funds, increasing financial stability and eliminating the headache of monitoring several PF accounts.

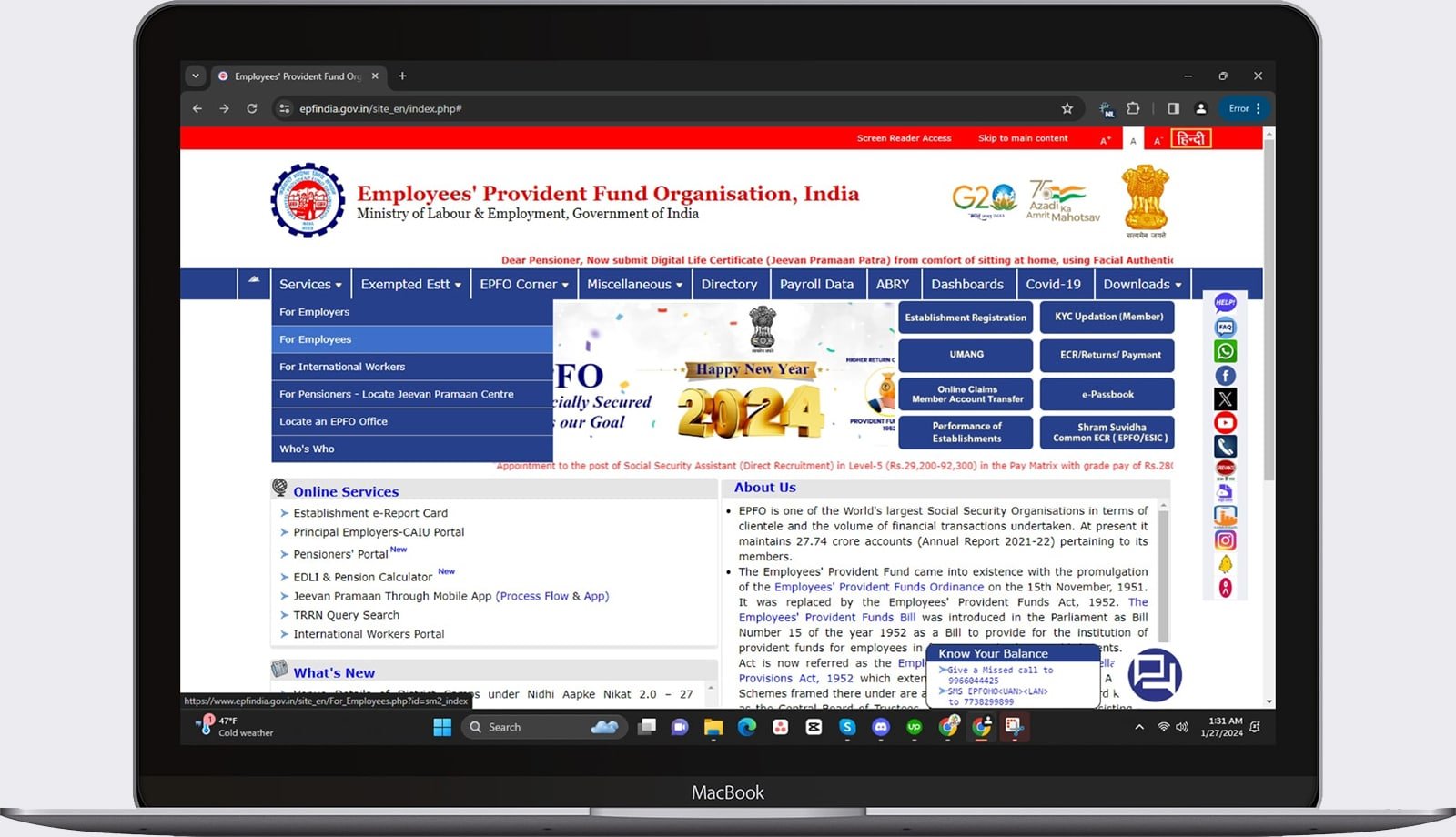

Transparency And Online Access

The Employee Provident Fund Organization (EPFO) has launched mobile applications and websites to enable employees to easily access and manage their Provident Fund (PF) accounts. Thanks to these services, employees may quickly check their account balances, obtain statements, and track the progress of their claims. This project aims to enhance transparency and streamline PF operations, giving employees greater control and access to financial benefits.

Refunds Guaranteed

In India, contributors to the Public Provident Fund (PF) receive a guaranteed rate of return on their investments. Bank savings account interest rates usually lag behind the annual rate declared by the Employees’ Provident Fund Organization (EPFO). This guarantees a consistent growth of the PF fund throughout time.