The EPF scheme is managed by the Employees’ Provident Fund Organisation (EPFO), which is the main program under the Employees’ Provident Funds and Miscellaneous Act, of 1952. EPFO is a non-constitutional body that encourages employees to save a portion of their salary for retirement. It works within the Ministry of Labour and Employment, part of the Government of India family.

In the EPF Scheme, both employees and employers contribute 12% of the employee’s basic salary and dearness allowance to the Employees’ Provident Fund. This fund earns interest and becomes available to the employee upon retirement. Currently, the interest rate on EPF deposits is 8.15% per year. This article explains the online claim process for EPF.

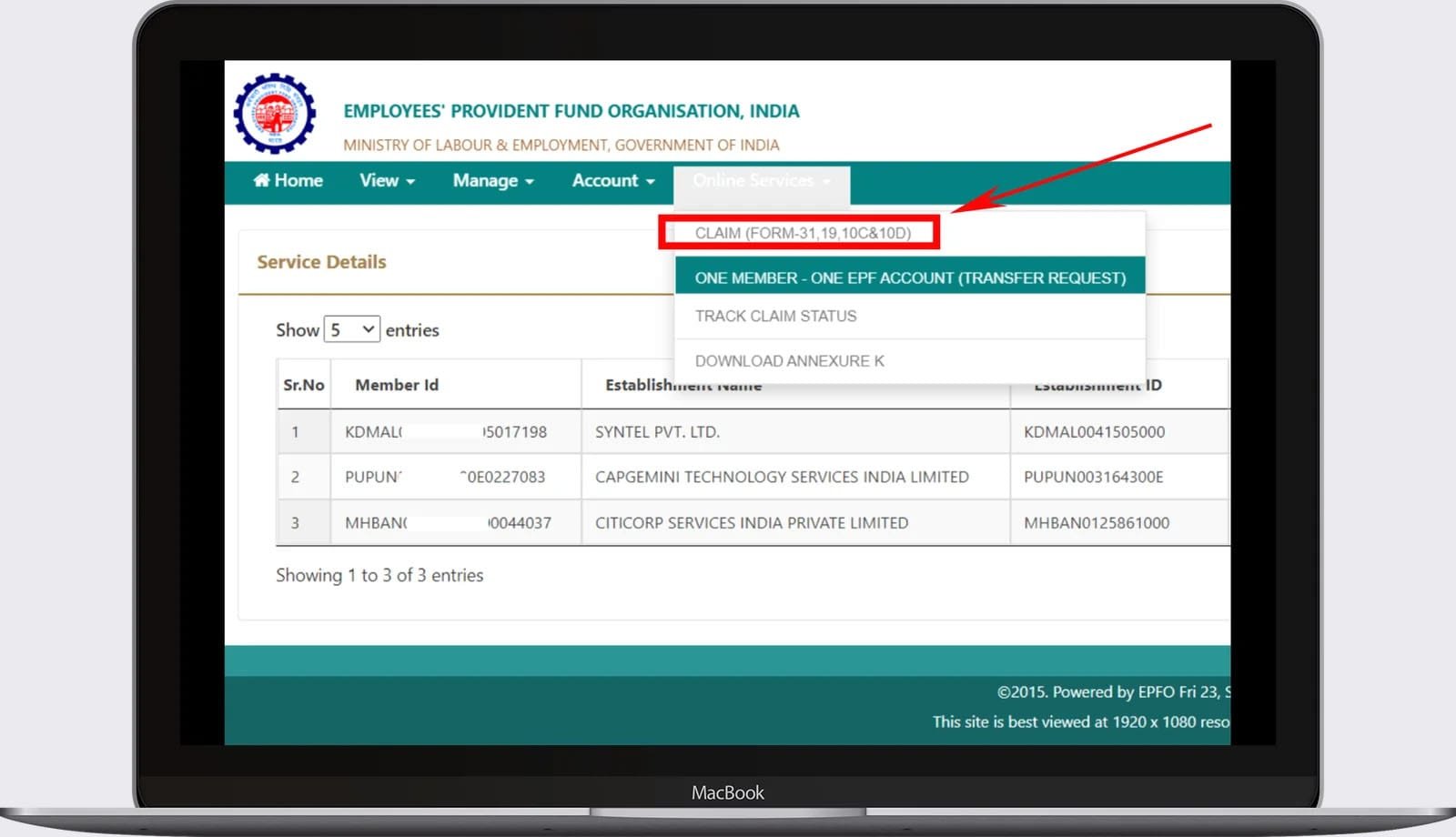

EPF Claim FORM Button

EPF Claim Forms come in various types

Employees can easily submit various claim forms through the UAN-Member Interface.

- PF Final Settlement (Form 19).

- Pension Withdrawal Benefit (Form 10-C).

- PF Part Withdrawal (Form 31) from the Member Interface directly.

Form 19 – Closing PF Account

When someone leaves their job, either by retiring, quitting or due to illness or retirement, they need to fill out a form called Form 19. This form is two pages long and requires specific information to be provided.

- PF account number.

- Bank account number (as registered by employer).

- IFSC code.

- Date of Joining.

- Date of leaving.

- PAN number (to avoid/reduce the quantum of TDS).

- Form 15G/15H (for senior citizens and members under the income tax limit, respectively).

Pension Fund Settlement Form 10C

Submit Form 10C to get benefits from the Employee Pension Scheme (EPS). This form is used to claim the following.

- Refund of employer share.

- Scheme Certificate for membership retention.

- Withdrawal Benefit.

These conditions apply to these situations

- If an employee’s total service is less than 9.5 years, and he/she is less than 50 years old, he/she can apply for a Withdrawal Benefit, which is a Pension Fund Money Back scheme. Such employees are not entitled to a pension.

- Only the Scheme Certificate can be claimed if an employee’s service is more than 9.5 years old and he/she is less than 50 years old.

Please provide the necessary information for Form 10C

- Last employer’s name and address.

- PF account number.

- Last working day.

- Full postal address.

- Bank account details.

Form 31 – Withdrawal from PF Partially

Form 31 is used when a member wants to take money in advance from their PF balance. This form lets you withdraw funds for different reasons, like.

- Purchase or construction of a house, land, or flat.

- Addition or alteration to a house.

- Refund of outstanding loan principal and interest.

- Closure of establishment for more than 15 days, leading to uncompensated unemployment.

- All wages received for at most 3 months.

- Discharge or dismissal under legal challenge.

- Health treatment for oneself or family.

- Education expenses for children.

- Equipment purchase for a disabled dependent.

- Withdrawal within 1 year before retirement.

Needed Documents for Filing EPF Online Claim

- Universal Account Number (UAN) and the mobile number used to activate it.

- AADHAAR details of the member.

- Member’s Bank Account information, including IFSC code.

- Permanent Account Number (PAN).

Guide for Processing EPF Claims Online, Step-by-Step

To take out money using any of the methods mentioned earlier, just follow these steps.

- Visit unified portal-mem.epfindia.gov.in.

- Log in with your UAN and password.

- Enter the captcha code and click Sign in.

- Select “Online Services”.

- Choose ‘Claim (Form 31, 19 & 10C)’ from the options.

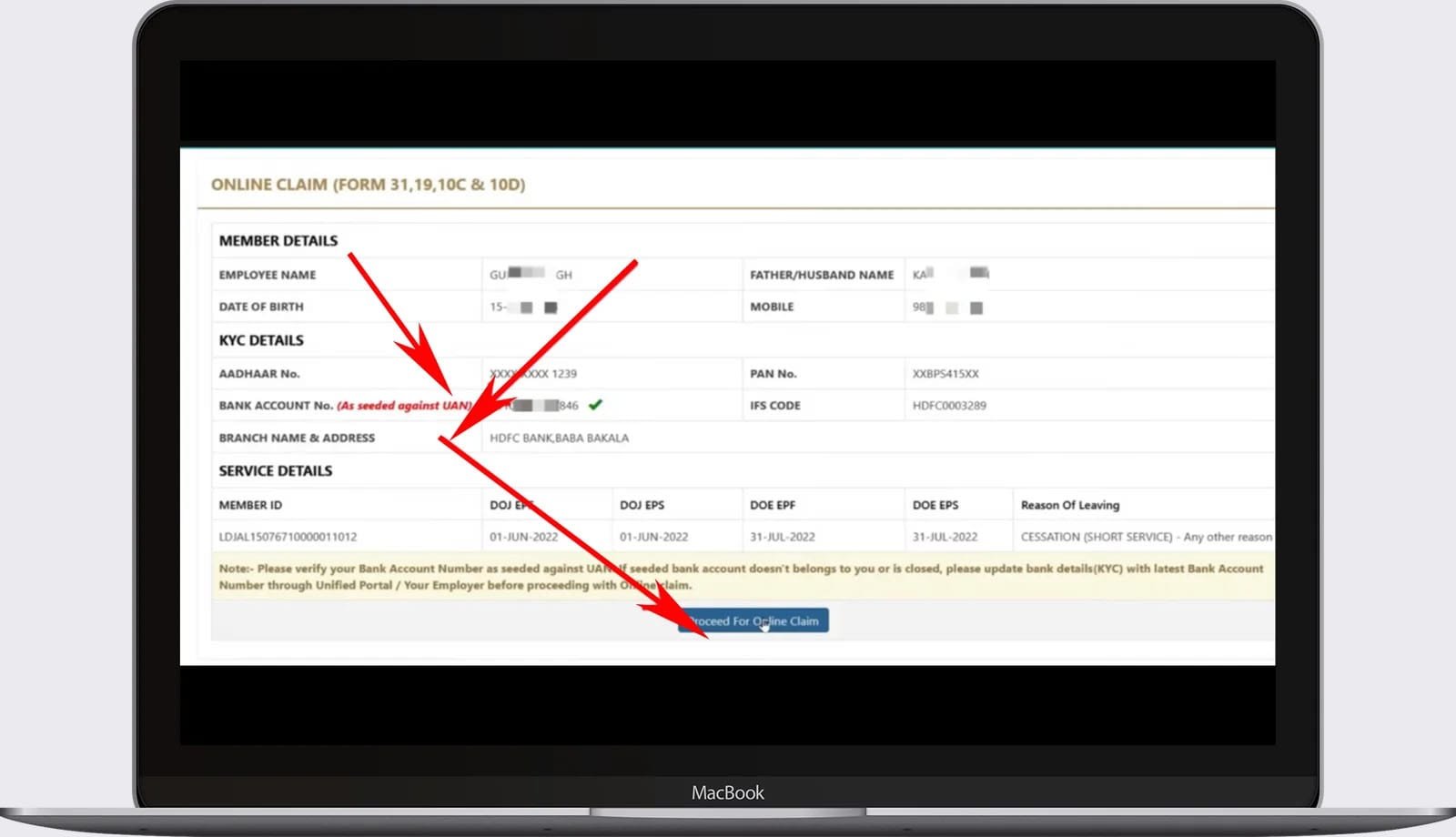

- Check all the information on this page, including your KYC details and extra service information.

- Please enter the final four digits of your bank account and click ‘Verify’. Ensure you provide the details of the account number given during UAN registration.

- A task will appear on your screen. Choose “Yes.” The task will state that the EPF claim amount will be deposited into the specified bank account.

- Now, select ‘Go for Online Claim.’

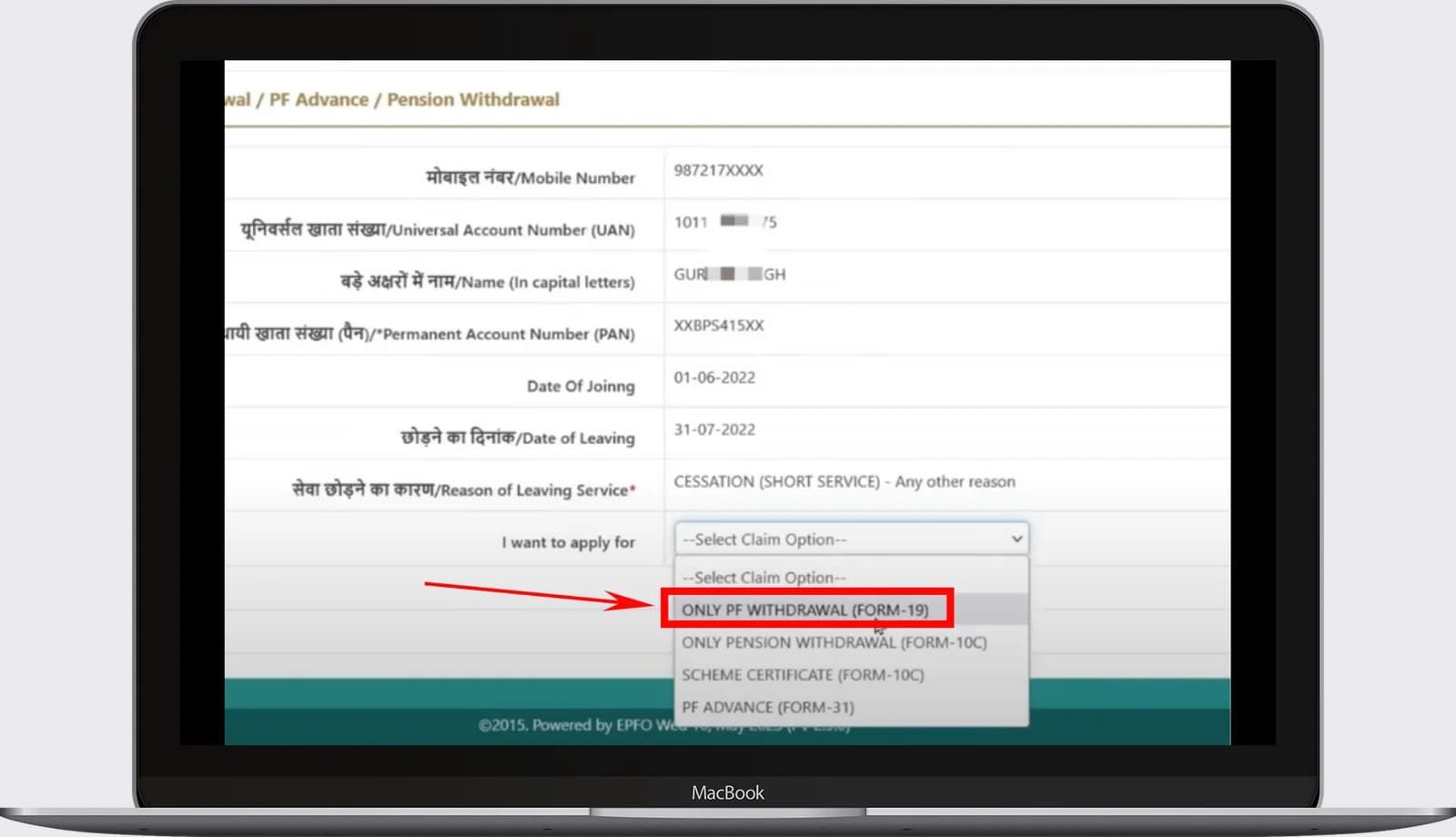

- Choose one of the following options based on your needs: Full EPF Settlement, EPF Part Withdrawal, or Pension Withdrawal.

- Choose the right reason from the ‘Purpose for which advance is required’ dropdown menu.

- Please input the advance amount needed.

- Please upload certain documents when prompted for approval. Then, proceed to approve the withdrawal request.

Your EPF withdrawal is done. You’ll get the money in your account in 15–20 days after applying.